Good news! Calculating Customer Lifetime Value is easier than ever. All you have to do to view this important metric is open up your Springbot app.

If you’re new to marketing, the term “Customer Lifetime Value” probably doesn’t mean anything to you, but it’s an important aspect of planning promotions. Knowing and understanding Customer Lifetime Value, or CLV, can guide who you market to, what you send them and make a big difference in your results. To understand why CLV is important, you first need to know what it is and how to calculate it.

What is CLV?

As you may have guessed, Customer Lifetime Value is the value of a customer to your company, in that it is how much a customer will spend, adding value to your company over their lifetime. Essentially, it’s a way to quantify how valuable individual customers are to your company.

Calculating CLV is difficult and can involve a lot of assumptions and (educated) guesswork. For larger companies, an exact metric is almost impossible to obtain, while smaller companies may have an easier time. To calculate CLV, take the amount of revenue gained from one customer (how much it is projected they will spend with you in their lifetime) and subtract the amount it costs to gain/acquire said customer (often referred to as customer acquisition cost or CAC).

[(average monthly revenue)*(average customer lifespan)] – CAC = CLV

Say you had a marketing campaign that you spent $10,000 on that resulted in 100 new customers, the cost of acquiring each customer would be $100. If one customer spent $15 at your store and doesn’t seem to come back, they would have a CLV of -$85, but if you have a customer who spent the same amount and is projected to spend that amount 20 times over their lifetime, their CLV is $200.

Now that we have the math out of the way, we can delve further into how to calculate CLV for an entire company rather than just one customer. The metric we provide and the one you should consider, is the average CLV of all of your current customers. This will tell you, in general, how much of a profit you’re making based on how much you’ve spent on obtaining your customers.

This number will be the guiding force behind your initial marketing strategy.

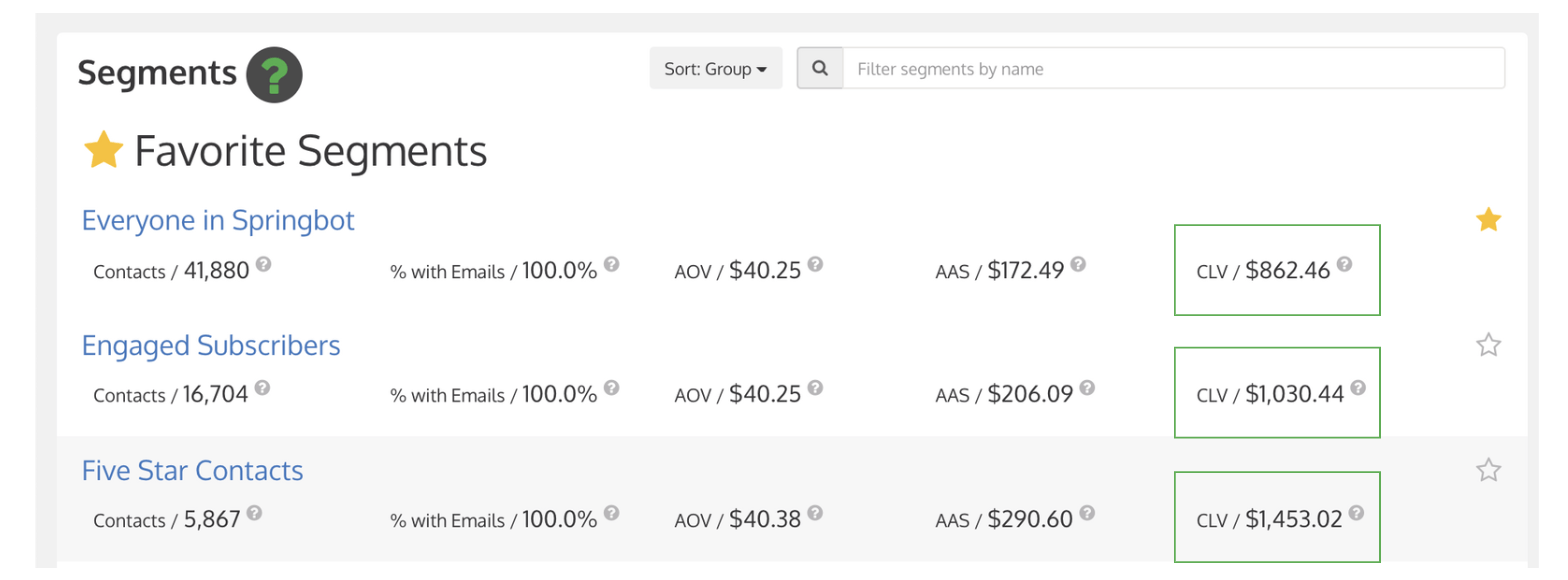

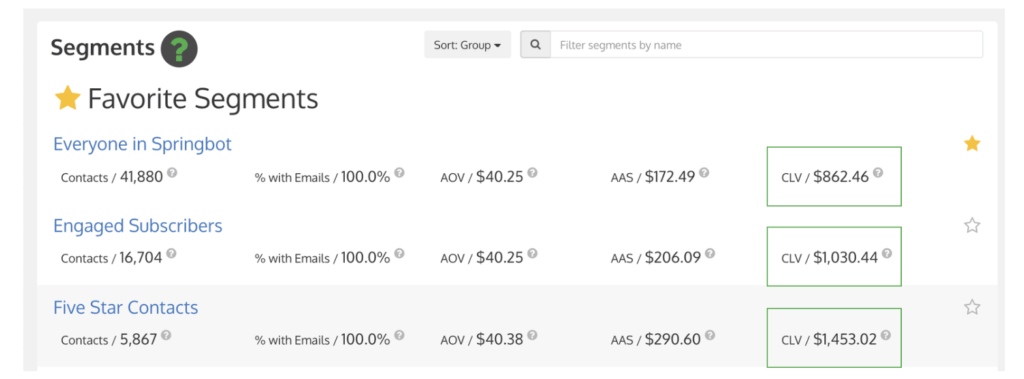

The Springbot dashboard view in Favorite Segments makes it easy to see CLV in different contexts.

Why does CLV matter for eCommerce marketers?

We know what you’re thinking, ‘This is cool information, but what does it have to do with marketing strategy?’ Customer Lifetime Value is one of the eCommerce marketing metrics you should consider when deciding on upcoming strategy. This metric will guide the direction you will go with future campaigns. Will you be focused more on bringing new customers in or trying to keep your current customers happy and spending? While doing both is ideal, you want to know which to throw more of your money and manpower into. CLV will tell you which decision is better for your company.

CLV would be a major deciding factor when considering two options: A large marketing blast to attract as many new customers to your site as possible, or shifting your strategy to put a major focus on customer retention.

Customer Experience Focus for High CLV

If your CLV is high, it would be a good idea to really focus on customer experience. Making key investments in customer service to ensure a positive end-to-end customer experience will help you better retain customers. You will also want to review order flow and checkout to make sure you are delivering a turnkey experience.

On the marketing side, consider loyalty programs, offering special deals to existing customers, and sending exclusive discount codes to email subscribers. These are all great ways to keep customers existing customers happy.

With so many stores doing price matches, the price of an item is no longer the thing a consumer focuses on the most. Instead, they will be looking at the overall customer experience. How do you incentivize existing customers? Do they earn points for the purchase? These things will guide a customer to purchase an item or service from you rather than a competitor who doesn’t offer these perks. Loyalty programs and customer experience can go a long way toward great customer retention, thus improving your CLV.

Growth Focus for Low CLV

If you notice your CLV is low, it might behoove you to focus on ways to find new customers that will either spend a lot once based on your campaign or become loyal customers who will eventually help raise your CLV. Spending money on more advertisements and offering a big discount to first-time shoppers can help you gain new customers. Consider investing in prospecting campaigns and offering that discount with retargeting to entice window shoppers. Keeping CLV in mind can help you think of ways to get them to spend big and stick with you to increase their overall value to your company.

Mastering eCommerce marketing metrics doesn’t have to be complicated. With the help of Springbot, you can view your CLV in app and use the knowledge you’ve gained to help it guide your strategy.